Participants, speakers and organisers of the AML & ESG Executive Training 2025 in Naivasha

We have just held our very first offline event, something we had been looking forward to for a long time. When the moment came to choose where this new chapter should begin, the answer revealed itself almost instantly: Kenya.

Not simply a point on a map, but a place where missions, people and challenges that matter right now naturally come together.

We didn’t travel there just to “deliver a training”. We travelled with a purpose: to share practical expertise, to understand the local landscape, to listen, and to work alongside professionals who are strengthening Kenya’s financial integrity today.

That is how AML & ESG Executive Training 2025 in Naivasha came into being, three days where European practice met Kenya’s rapidly evolving reality, shaped by one of the fastest-growing digital finance ecosystems in the region and by urgent AML, CFT and transparency reforms ahead of FATF assessments.

Why Kenya?

The choice was anything but accidental.

Kenya stands as one of East Africa’s strongest business and technology hubs. Innovation moves at remarkable speed here, across a fast-growing digital finance ecosystem, creating a growing need for solid, risk-based AML frameworks.

The country is developing its National Risk Assessment, strengthening supervisory capacity and refining regulatory tools. For us, contributing to this journey is more than a professional engagement; it is an opportunity to build a meaningful, long-term bridge between Europe and Africa, founded on shared standards and real competence. This programme became not just an event but the beginning of deeper institutional cooperation.

Our focus

We designed the programme as a hands-on laboratory, grounded in real scenarios rather than traditional presentations.

Key themes included:

- managing high-risk channels such as crypto and cross-border transactions

- integrating ESG considerations into AML and governance frameworks

- regulatory perspectives on virtual assets, MiCA and CASP licensing

- the first Closed-Door Regulators’ Roundtable, bringing together Kenyan supervisors and European experts

We also explored how modern AML training can be embedded into compliance systems as a measurable indicator of organisational maturity and AML culture.

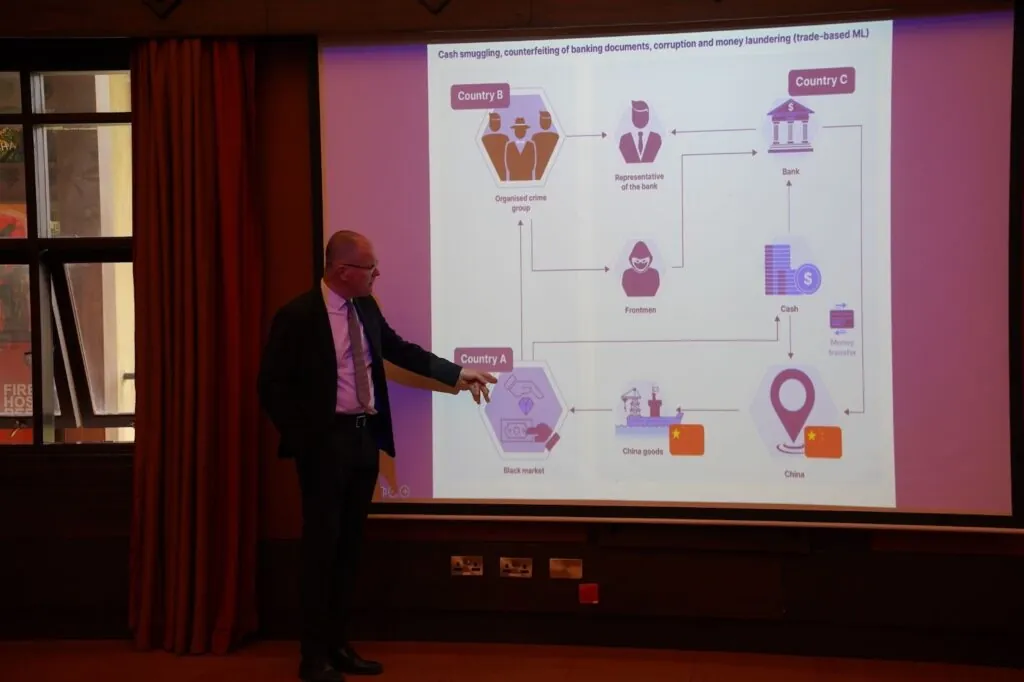

Viktor Tkatsenko, Head of AML & Security Department at Citadele Bank (Estonia), during his presentation

Igoris Krzeckovskis, international AML expert, during his presentation

What participants gained

Each module went beyond theory. Participants stepped into practical situations that required them to:

- apply the risk-based approach to clients and transactions

- manage crisis communication and engagement with the FIU

- interpret ESG factors within KYC and corporate governance

- draft internal reports and defend decisions as they would in a real supervisory review

Participants didn’t simply listen; they practised, debated and experienced the process together.

The highlight of this approach was a full-scale simulation of a supervisory AML inspection, developed by AML Certification Centre and introduced in Kenya for the first time.

The exercise recreated a realistic supervisory environment, where quick decisions, clear communication and coordinated teamwork matter just as much as technical knowledge.

Unlike standard trainings, this was an inspection “as it happens”.

Participants preparing for the full-scale supervisory AML inspection simulation

Teams represented different financial institutions and received only minimal information about their fictional organisation. Then the “inspectors” entered the room, trainers with real experience in investigations, FATF assessments and supervisory reviews in Europe, and opened the inspection immediately.

The process followed the structure of an actual on-site review. Inspectors:

- announced the start of the inspection

- presented a formal “notice”

- requested documents and clarifications

- conducted short interviews

- asked the types of difficult questions supervisors typically raise during real visits

Throughout the exercise, participants had to:

- assign roles (MLRO, Compliance, Legal, Operations, Analyst, etc.)

- respond to initial document requests

- explain key elements of their AML framework

- justify decisions, rather than rely on templates

- prepare a concise Management Response to preliminary findings

By the end, each team had gone through the full lifecycle of an inspection.

This made it possible to identify real gaps in role clarity, communication, data gathering and structuring evidence of compliance.

The simulation left a strong impression. Many participants said it was the first time they could truly see their AML system through the regulator’s eyes and understand what preparedness looks like in practice.

Discussion during the inspection simulation with Viktor Tkatsenko

Partnerships that made it possible

The event was supported by the Estonian Ministry of Foreign Affairs and the Honorary Consul of Estonia in Kenya, highlighting its diplomatic and strategic importance.

Local context and legal expertise were provided by TMM & Partners Advocates, kenyan legal experts. Gofaizen & Sherle contributed their European regulatory experience, particularly in CASP licensing and virtual asset frameworks.

Andrei Sribny, Chief Executive Officer of AML Certification Centre, and Robert Muoka, Senior Partner at T.M.M & Partners Advocates, together with Kadri Humal-Ayal, Honorary Consul of Estonia in Kenya

The main takeaway

Across all three days, one conclusion was clear: an AML system only works when the people operating it truly understand it.

Kenya is undergoing a major transformation of its AML landscape. This moment is crucial not only for implementing new rules but for building practical, sustainable systems tailored to the country’s fintech realities and mobile-first financial environment.

Our mission in Kenya was simple and honest: to strengthen local capacity, share real-world expertise and lay the foundation for ongoing cooperation between Europe and Africa in financial transparency and sustainable development.

Participants with their certificates, together with organisers and speakers of the AML & ESG Executive Training 2025

And this is only the beginning.