AML Certification Centre

The most practical and regulator-recognized AML certification – trusted worldwide.

About us

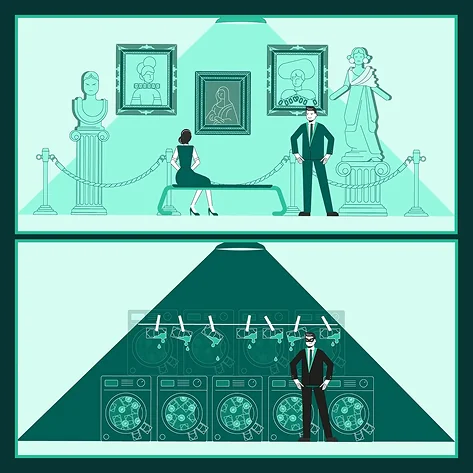

AML Certification Centre is a globally recognized accreditation and training institute operating in accordance with the requirements of the regulators and global standards. We certify Anti-Money Laundering Specialists qualifying them to work in the regulated businesses, such as Banks, Crypto, FinTechs, Gambling & iGaming, Investment, Trading etc.

Each of our programs is developed by a team of professional trainers and field experts. We have a unique methodology to find experts who are best specialized in a particular business area or who have experience in AML/CTF+ in different countries.

Freedom to Learn – No Schedules, No Limits.

Complete our AML-Program to earn a CPD-accredited certificate! Boost your skills with recognized certification.

Complete our AML-Program to earn a CPD-accredited certificate! Boost your skills with recognized certification.

Discover the freedom to learn on your terms, with no fixed schedules

or location requirements. Our AML certifications are valued worldwide, and

each course is crafted with precision to boost your skills.

Affordable options make professional growth accessible, and you’re

never alone — our support team is available 24/7 to assist you.

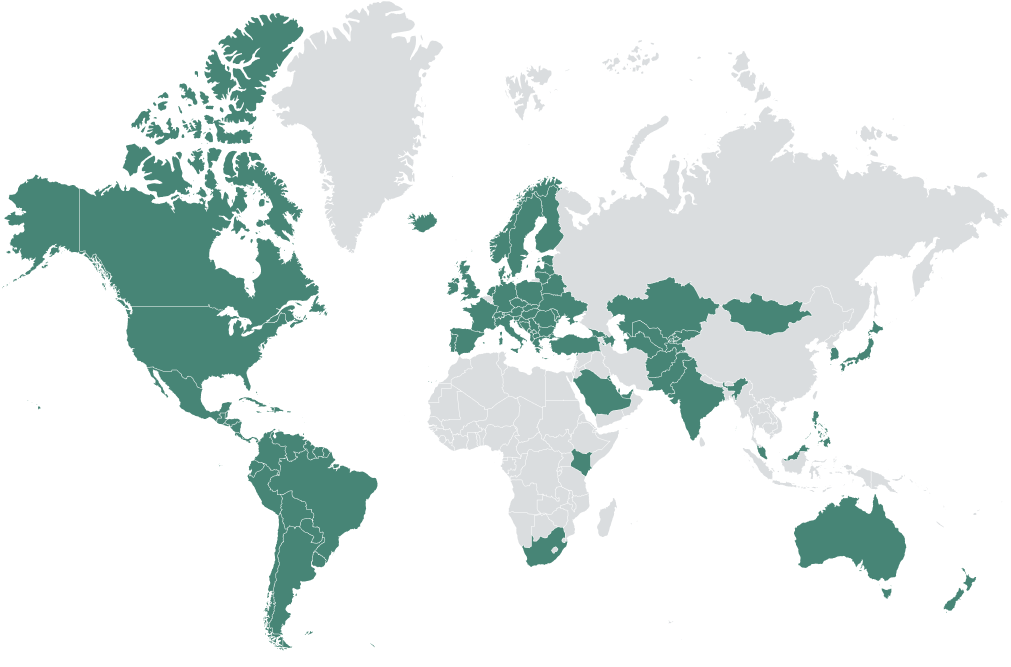

Join learners from 79 countries and see why 91% of our graduates

advance in their careers.

Global Recognition

trusted worldwide.

Premium-Quality Content

to enhance your skills.

Flexible & Convenient

24/7 Support

your success is our priority.

Our Anti Money Laundering Certifications

Education Solution for Success

customized to the specifics of your business.

companies and their compliance employees.

with certified professionals, get necessary AML certification.

Our Experts

Watch More on

Unlock top-tier AML certification programs and training by leading experts. Level up your skills

and join the community of financial crime fighters.

Together, we ensure safety!

What People Say About Us

5/5

5/5

Equipping compliance professionals with the tools to identify and neutralise threats obligated entities face – AML Certification Centre training programs are an effective Anti-Financial Crime toolkit from practitioners for practitioners.

Read More

5/5

5/5

“This is one of the best AML/CTF training I’ve ever had in my professional career combating financial crime for over than 15 years. In my opinion AML Certification Centre’s AML/CFT course is more valuable and relevant than other similar organizations provide. You can choose the tailored training based on your knowledge level and improve it. If you want to have interesting reading and localized training – you should definitely take it!”

Read More

5/5

5/5

“I was searching for new qualifications and due to high demand for AML specialists my choice fell on this line of work. As a newcomer I took the foundations course. The materials presented to me further ignited my interest, the lessons were well structured, video materials combined with text were especially useful for digesting information. I felt like a few mid-course tests were a bit hard, but upon completion I revised my notes and it all made sense. Overall, I am satisfied with this course and its length, it fit perfectly into my schedule and I want to continue my education with this provider.”

Read More

5/5

5/5

“Awesome course with big amount of materials. The best part is that this course can be done whenever you have time and streight to learn. Thank AML Certification Centre for this course.”

Read More

5/5

5/5

I’m really satisfied with the CASS certification program. It gave me useful insights and knowledge that I’ve already started using at work, even before finishing the final test and getting certified. This definitely helped me boost my skills and confidence and clarified many points. I recommend this course to anyone waiting to learn more about AML/CTF principes and practices! The platform is also great, and the customer support really fast.

Read More

Education

Education  Check Level

Check Level

Visit Our Channel

Visit Our Channel Play on YouTube

Play on YouTube Igoris Krzeckovskis

Igoris Krzeckovskis